Blog

Intermodal Spot Rates November 2020: A look by market

The content below is for brokers interested in utilizing the DrayNow spot market. For brokers interested in securing intermodal drayage service for their contracted lanes, please feel free to reach out to us via contact form.

For a look at last month’s data dive on spot rates, click the link here.

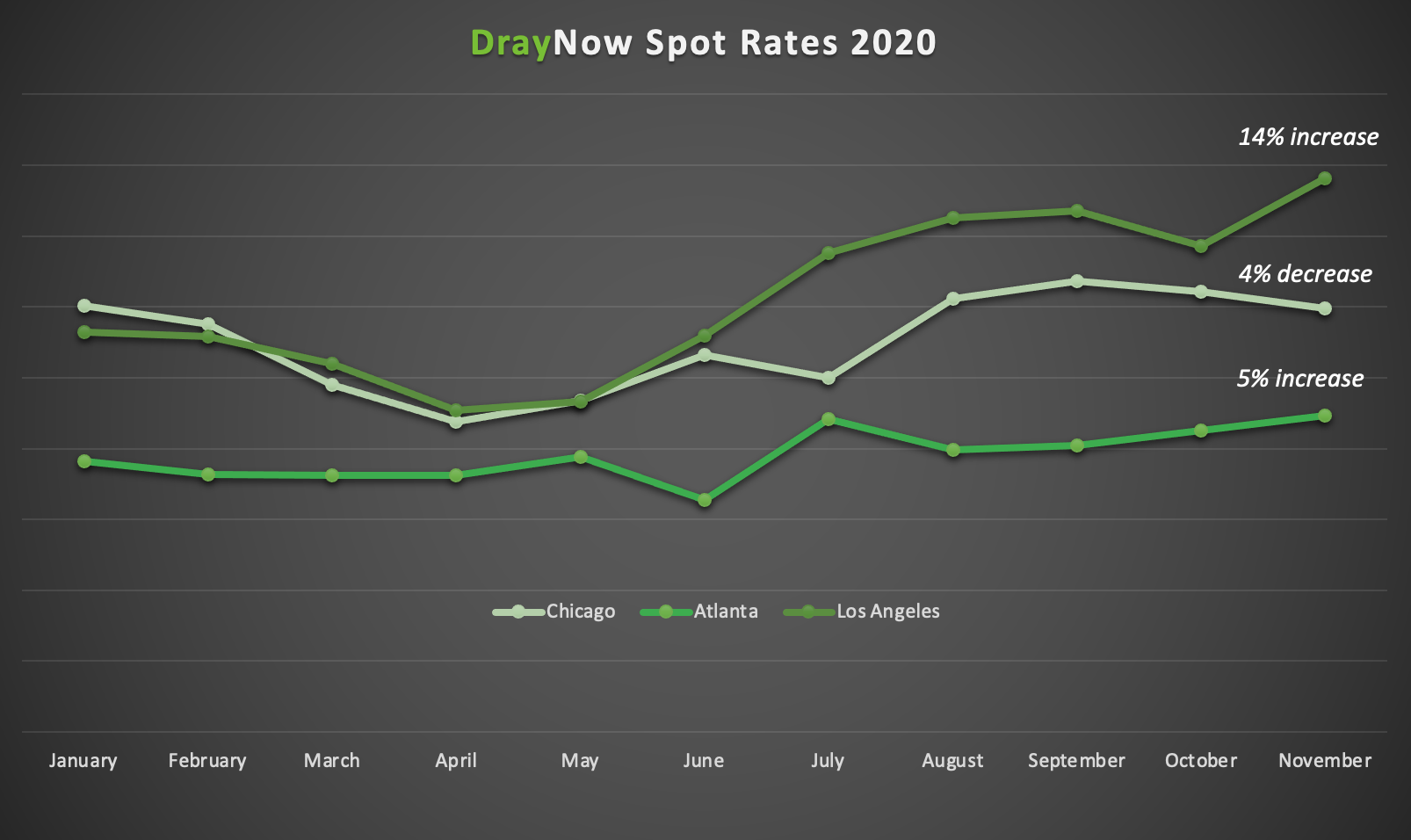

The holiday season is in full force as spot rates across our key markets hit some of their highest points this past month. Both Los Angeles and Atlanta have seen record averages while Chicago rates continued to decrease slightly after hitting a year high in September.

Taking a closer look at this graph, you can see that Los Angeles has responded in a major way to the ongoing peak season, jumping much higher than levels we saw prior to the decrease in October. Chicago appears to have peaked earlier than expected, with averages slowly coming down from an above average high point in September. Much like it has been all year, Atlanta average rates are staying relatively the same, but picking up as we progress through Q4.

Looking at how this peak season may compare to last year, we’re already seeing higher averages in Chicago and Los Angeles, with rates expected to rise as well. This is encouraging news as the industry continues to weather the pandemic that crippled it just a few months ago. From the low points of this spring, spot rates are up 37% in Chicago, 36% in Atlanta and a whopping 68% in Los Angeles.

Since our last spot rate update, we’ve put together a data deep dive regarding spot freight behavior on the DrayNow marketplace. This is another tool to utilize when pricing your freight, because as the data shows, loads that are posted last minute are generally taken at a much higher rate per mile, and vice versa. As average rates go up anyway due to peak season trends, it may be useful to utilize this data on lead time so that you aren’t paying even higher rates because of a last-minute posting to the platform.

Based on the current trends and historical data, we likely will see even higher average rates for December. As Tom Ryan, VP of Business Development, said in the latest DrayNow webinar, he expects the industry to see higher volumes shifting from over-the-road and higher average rates through the first quarter of 2021. And as we stated in our assessment of intermodal ahead of peak season, capacity is going to tighten with all of this excess volume moving to intermodal, paving the way for more rate hikes.

Freight Inquiry Submission

"*" indicates required fields

Sign Up

Shipping Freight? Get our new E-book.

Download our free e-book "Is there a future for Intermodal Marketing Companies?" and get DrayNow updates delivered straight to your inbox.

"*" indicates required fields