Blog

Intermodal Spot Rates June 2023: A look by market

The content below is for brokers interested in utilizing the DrayNow spot market. For brokers interested in securing intermodal drayage service for their contracted lanes, please feel free to reach out to us via contact form.

For a look at last month’s data on intermodal spot rates, click the link here.

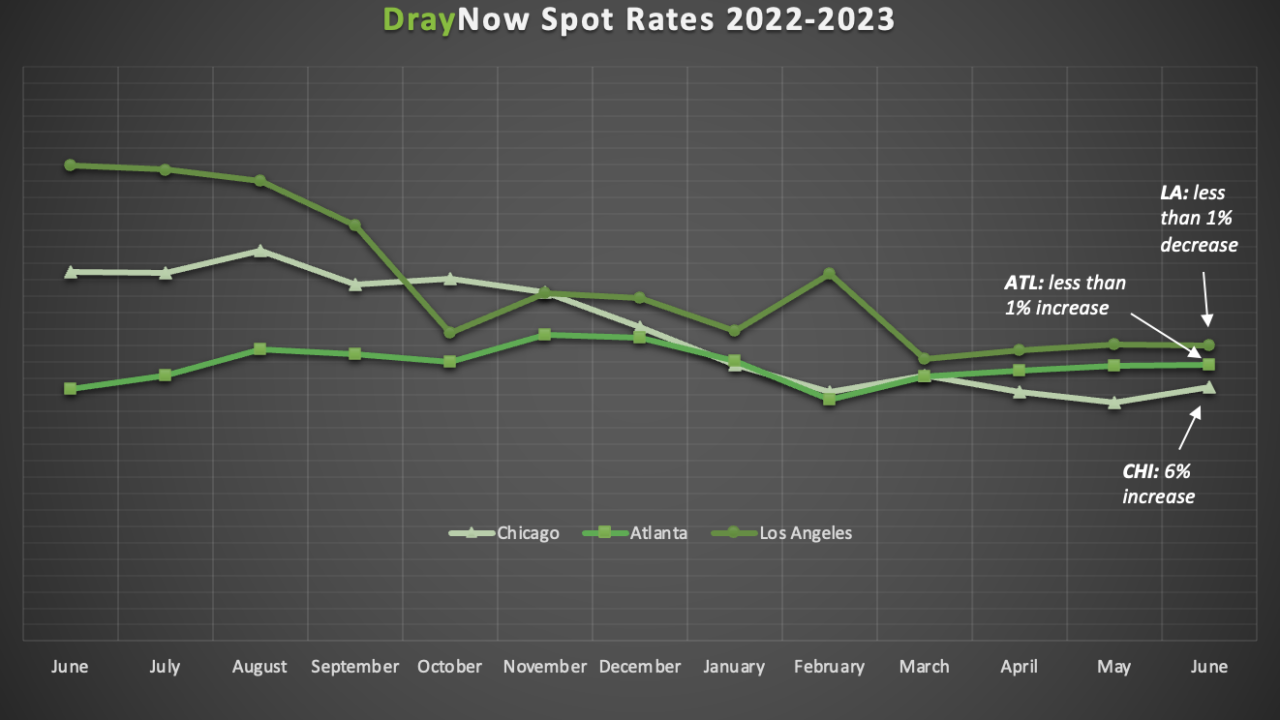

With the exception of the Chicago market, intermodal spot rate trends on the DrayNow platform in June were almost exactly the same as what we say in May. The cost to move intermodal freight was down less than 1% in Los Angeles and up less than 1% in the Atlanta market. Chicago intermodal spot rates on the other hand were up 6%. Since one market jumped in prices while the two others hit a plateau, average spot rates are trending very close to one another.

Rates in the Chicago market were up 6% month-over-month following two months of steady average spot rate declines. The previous month’s percentage decrease actually brought intermodal drayage rates to their lowest point since 2021, so the June numbers show a small but notable bounce back from that record low. Compared to June 2022, the cost to move intermodal freight in Chicago is still 31% lower in 2023.

The Los Angeles intermodal market saw a decrease in the average spot rate of just less than 1%, showing that the market has been running with incredible stability over the past two months. Intermodal freight costs not changing much at all means that carriers are finding the current rates available to be fairly competitive. Taking a look at LA drayage rates last year, rates in June 2023 were down 38%.

While Los Angeles spot rates were up less than 1%, Atlanta rates were down less than 1% compared to last month. Since average spot rates were almost exactly the same but slightly lower in the current month, carriers are clearly finding these rates very competitive. The Atlanta market has average spot rates that are 9% higher than the previous year.

Atlanta and Los Angeles spot rates were relatively the same this month compared to May, and also saw 2% increases in rates between April and May. With this in mind, are intermodal spot rates bottoming out? The question of when both truckload and intermodal rates would hit their low before rising again has been on the minds of many in the industry for months now. We will have to keep looking forward at the numbers for July to see if this trend continues and if rates are in fact bottoming out.

Freight Inquiry Submission

"*" indicates required fields

Sign Up

Shipping Freight? Get our new E-book.

Download our free e-book "Is there a future for Intermodal Marketing Companies?" and get DrayNow updates delivered straight to your inbox.

"*" indicates required fields