Blog

Intermodal Spot Rates August 2021: A look by market

The content below is for brokers interested in utilizing the DrayNow spot market. For brokers interested in securing intermodal drayage service for their contracted lanes, please feel free to reach out to us via contact form.

For a look at last month’s data dive on intermodal spot rates, click the link here.

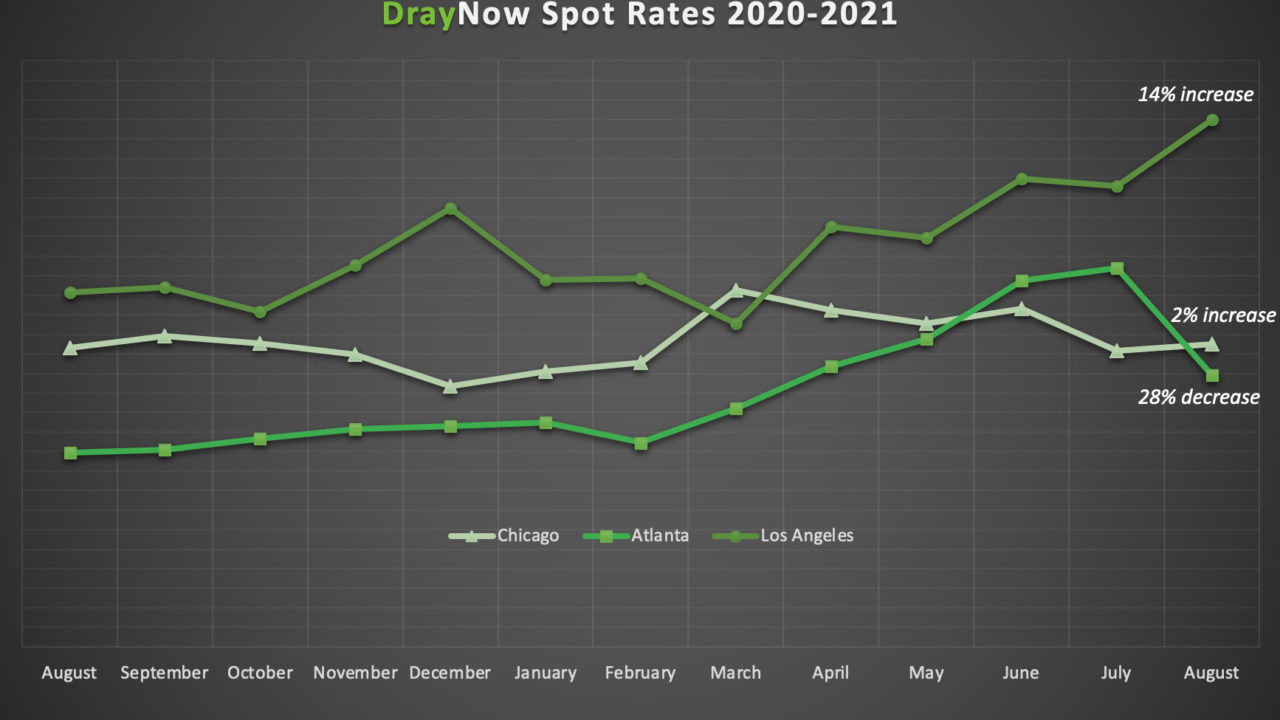

In July’s analysis, we highlighted that, besides Chicago, spot rate behavior across our key markets held steady. For the month of August, the complete opposite took place. While the Chicago market saw a slight percent increase following months of overall decline, both Atlanta and Los Angeles saw double digit percent changes.

The story begins in Los Angeles, where average spot rates surged 14% to their highest level ever. What’s the reason for this record rate per mile? According to the JOC, equipment shortages and intermodal congestion have led to higher rates in this area. What’s striking is the significant difference between current LA rates and the average rates of our other key markets. Compared to Chicago and Atlanta, LA rates are 54% and 64% higher, respectively.

Looking at Atlanta, rates here saw a significant dip, down 28% from last month. Rates in Atlanta decreased so considerably that the average rate is back below the average of Chicago for the first time in three months. Even though the average rate in the Atlanta market is down, it’s still higher than rates seen earlier this year, as well as the entire fourth quarter of 2020.

Following months of month-over-month drops in the average spot rate, Chicago saw a 2% increase in August. The increase in rates could not offset the 12% drop this market saw last month, as rates are still down from the highs seen this past spring and early summer. Compared to August 2020, Chicago spot rates are almost at the exact same place, with this year’s average being just 1% higher.

As we head into intermodal peak season, average spot rates are almost guaranteed to increase. With the volatility seen in the current spot rate trends of our key markets, the question becomes: When will we start to see peak season rates? And, how high will they go?

Freight Inquiry Submission

"*" indicates required fields

Sign Up

Shipping Freight? Get our new E-book.

Download our free e-book "Is there a future for Intermodal Marketing Companies?" and get DrayNow updates delivered straight to your inbox.

"*" indicates required fields